On The Money: Google Pay, Samsung Pay and Apple Pay Explained

- 29 March, 2018 13:38

Over the last ten years, smartphones have replaced MP3 players, PDAs, cameras and - for some - even dedicated portable computing devices like laptops. Now, smartphone and wearable vendors are trying to replace your wallet by cementing themselves as a crucial part of the mobile payments space.

If you’re confused about things like Apple Pay and Samsung Pay - here’s everything you need to know.

What are mobile payments services?

Mobile Payment services (also known as mobile payment platforms or digital wallets) is a term that refers services or apps that allow you to pay for things with your phone or smartwatch (via a connected credit or debit card). The basic idea here is for these devices to ultimately replace a physical wallet, allowing you to carry one less thing around with you on a day-to-day basis.

Why would you want to use one?

Convenience is central to the whole concept of mobile payment services. You already always have your phone on you all the time anyway, why not use it as a wallet?

Why might you not want to use one?

Well, there are a couple of things to highlight here - most of which occur on a practical level.

First of all, your devices can and will eventually run out of battery. Physical cards don’t suffer that drawback for obvious reasons.

Likewise, not every shop out there supports payment via EFTPOS let alone specific mobile payment services like Google and Samsung Pay. Online shopping can be tricky for similar, albeit more-digital, reasons.

Credit: Samsung

Credit: Samsung Then, there’s the payment services themselves to consider. These days, most major banking and financial institutions are supported by most of the major mobile payment services but there’s still a chance that - for whatever reason - your current bank might not support it.

On a practical level, mobile payment services also just extra steps to the everyday process of paying for things. Depending on your service of choice, you might have to open an app, log-in and then confirm the purchase - which can seem a little excessive compared to the regular contactless payments experience.

Security-nerds might also scoff at the idea of putting all their financial details into a single digital box, as it creates a new avenue for attack. Should Google or Apple or Samsung’s pay services ever get hacked or leaked, the potential damage her could be catastrophic.

What services are there?

There are tons of mobile payment services out there. However, the five main ones are Google Pay, Apple Pay, Samsung Pay, Fitbit Pay and Garmin Pay.

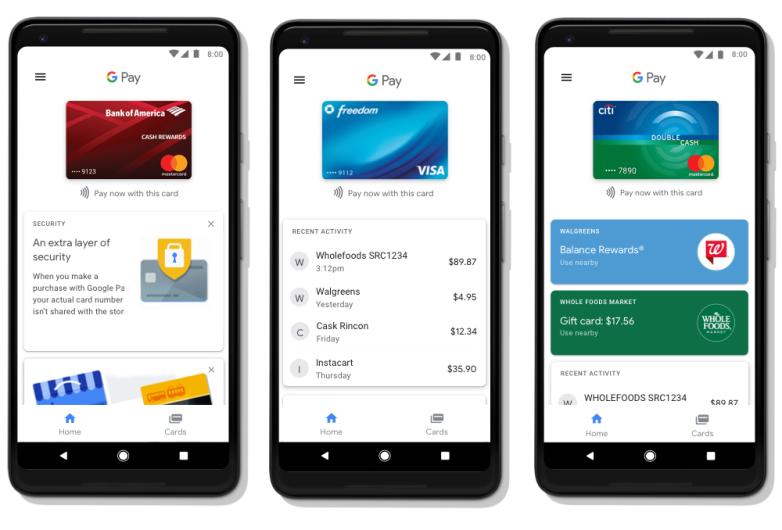

Google Pay

Credit: Google

Credit: Google What is it?

The mobile payment service formerly known as both Android Pay and Google Wallet.

Who can use it?

Theoretically, anyone with an Android phone can download the Google Pay app. However, your device does need NFC connectivity to use it. You can also use it with smartwatches running on Android Wear AKA Wear OS.

How many banks are supported?

A lot. At the time of writing, Google Pay supports Mastercard, Visa and AMEX cards from over 50 banks in Australia.

However, it should be noted that each bank decides whether each of its cards will work with Google Pay. IE: Commonwealth Bank might offer Google Pay but not on every credit or debit card. If it's not clear whether your current card supports mobile payments, it's best to get in contact with your bank directly to find out.

Credit: Google

Credit: Google Which major Australian banks offer Google Pay?

- AMEX

- ANZ

- ING Direct

- Bank of Melbourne

- BankSA

- BankWest

- Bendigo Bank

- Commonwealth Bank

- Heritage Bank

- HSBC

- Macquarie Bank

- NAB

- St George

- UBank

- Up Money

- Westpac

- Suncorp

Which smaller Australian banks support Google Pay?

- AMP Bank

- Australian Unity

- AWA Alliance Bank

- Bank Australia

- Bank of Heritage Isle

- Bank of Sydney

- BankVic

- BDCU Alliance Bank

- Beyond Bank Australia

- Border Bank

- Central Murray Credit Union Ltd

- Central West Credit Union Limited

- Circle Alliance Bank

- Community First Credit Union

- Credit Union Australia Ltd.

- Credit Union SA Ltd

- Defence Bank Limited

- Endeavour Mutual Bank

- Family First Credit Union Limited

- Firefighters Mutual Bank

- First Option Bank Ltd

- Geelong Bank

- Goldfields Money

- Goulburn Murray Credit Union Co-Op Limited

- Health Professionals Bank

- Holiday Coast Credit Union Ltd

- Horizon Credit Union Ltd

- Illawarra Credit Union

- IMB Bank

- Intech Credit Union Limited

- Latitude Financial Services

- Laboratories Credit Union Limited

- Maritime, Mining & Power Credit Union Ltd

- Myer Credit Card

- Mystate Bank Limited

- The Rock

- Nexus Mutual

- Northern Beaches Credit Union

- Northern Inland Credit Union Limited

- Nova Alliance Bank

- Orange Credit Union Limited

- People's Choice Credit Union Ltd

- P & N Bank

- Police Bank Limited

- Police Credit Union

- Queenslanders Credit Union Limited

- RACQ

- Reliance Bank

- Service One Alliance Bank

- South West Slopes Credit Union Ltd

- Sydney Credit Union Ltd

- Teachers Mutual Bank Limited

- The Mac

- UniBank

- Unity Bank

- WAW Credit Union Co-Operative Limited

- Woolworths Employees' Credit Union Limited

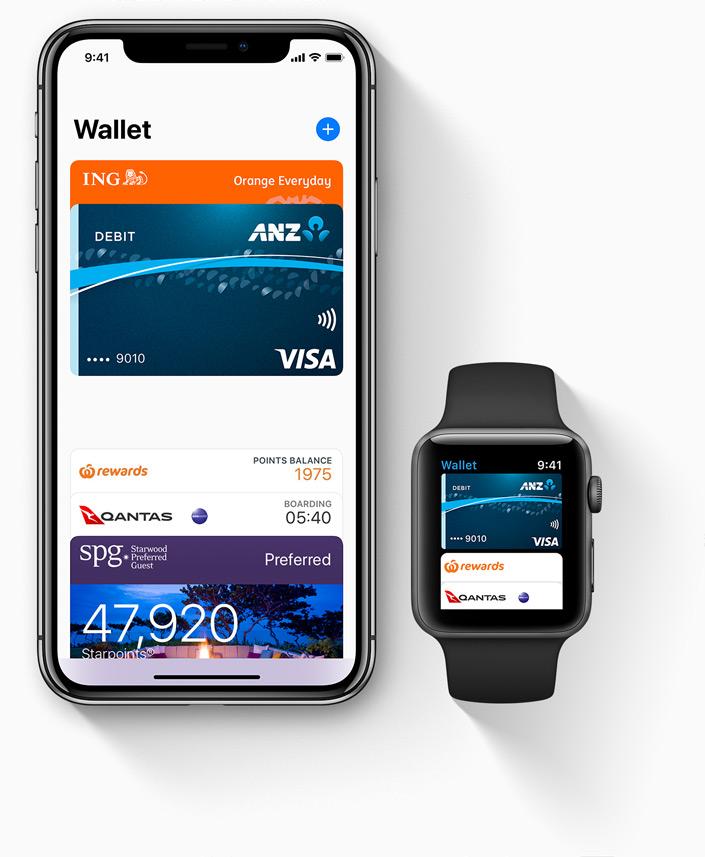

Apple Pay

What is it?

Apple’s own payments service, and the only payments service available for iOS users.

Credit: Apple

Credit: Apple Who can use it?

People looking to use Apple Pay need both an eligible iOS-powered device (iPhone 6 onwards, iPad Mini 3 onwards, any Apple Watch) running on the latest version of Apple’s software. They’ll also require an active Apple ID and a credit card from a supported financial institution.

How many banks are supported?

A fair amount. Though, after a tumultuous attempt to refer Apple to the ACCC over being unable to access the iPhone’s NFC chip, most of Australia’s ‘Big Four’ banks have yet to embrace the platform.

Which major Australian banks support Apple Pay?

- American Express

- ANZ

- Bendigo Bank

- Citi Australia

- Commonwealth Bank of Australia

- ING

- HSBC

- Macquarie

- NAB

- Suncorp

Which smaller Australian banks support Apple Pay?

- Australian Unity

- AWA Alliance Bank

- Bank Australia

- Bank of Heritage Isle

- Bank of Sydney

- BankVic

- Bankwest

- BDCU Alliance Bank

- Beyond Bank Australia

- Border Bank

- Central Murray Credit Union Ltd.

- Central West Credit Union Ltd.

- CIRCLE Alliance Bank

- Community First Credit Union Ltd.

- Credit Union SA Ltd.

- CUA

- Defence Bank

- DiviPay

- EML Payment Solution Ltd

- Endeavour Mutual Bank

- Firefighters Mutual Bank

- First Option Bank

- Geelong Bank

- Goldfields Money Ltd.

- Goulburn Murray Credit Union

- Health Professionals Bank

- Holiday Coast Credit Union Ltd.

- Horizon Credit Union

- Illawarra Credit Union Ltd.

- IMB Bank

- Intech Credit Union Ltd.

- Laboratories Credit Union Ltd.

- Latitude Financial Services

- Lombard Finance

- MyState Bank Ltd.

- Nexus Mutual

- Northern Beaches Credit Union

- Northern Inland Credit Union

- Nova Alliance Bank

- Once Credit

- Qpay

- Orange Credit Union

- P&N Bank

- People's Choice Credit Union

- Police Bank

- Police Credit Union Ltd.

- RACQ

- SERVICE ONE Alliance Bank

- Skye provided by FlexiCards Australia Pty Ltd

- South West Slopes Credit Union

- Sydney Credit Union Ltd.

- Teachers Mutual Bank

- The Broken Hill Community Credit Union Ltd

- The Mac

- UBank

- UniBank

- Unity Bank Ltd.

- Up Money

- Warwick Credit Union Ltd.

- WAW Credit Union

- Woolworths Employees' Credit Union

- Woolworths Group Limited

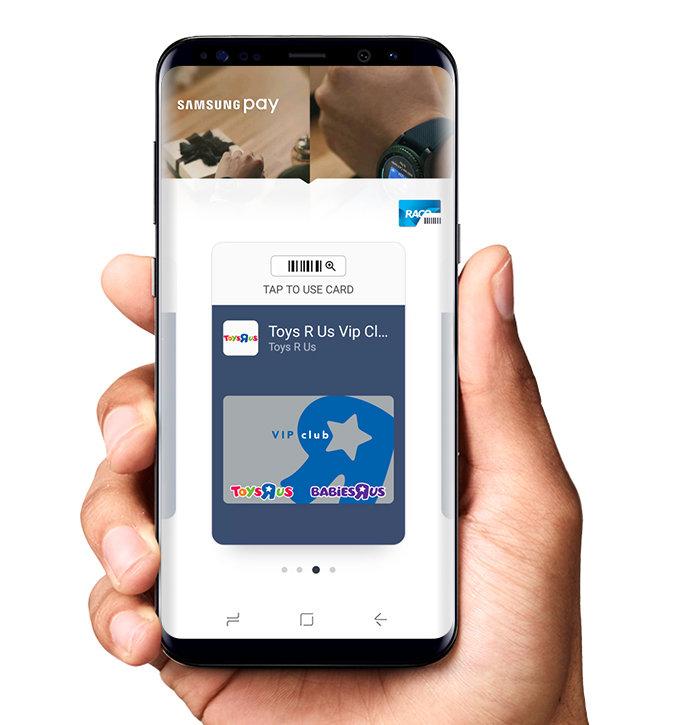

Samsung Pay

What is it?

Samsung’s own mobile payments services platform for its customers.

Credit: Samsung

Credit: Samsung Who can use it?

If you own a Samsung Galaxy S10, S10e, S10 Plus, A5, A7, S9, S9+ S8, S8 Plus, S7, S7 Edge, S6 Edge+, S6, S6 Edge, S6 Active, Note 5, Note 8 or Note 9 smartphone or a Samsung Gear (S2 and S3 only) or Galaxy Watch, you’ll be able to setup and use Samsung Pay.

How many banks are supported?

Just under fifty banks are supported by Samsung Pay.

Credit: Samsung

Credit: Samsung Which major Australian banks support Samsung Pay?

- Commonwealth Bank

- NAB

- ANZ

- Westpac

- Amex

- CITI

- St George

- Suncorp

Which smaller Australian banks support Samsung Pay?

- AMP

- Australian unity

- Bank Australia

- BankSA

- Bank of Sydney

- Bank of Melbourne

- Bendigo Bank

- Beyond Bank Australia

- Border Bank

- BOQ

- Central Murray

- Community First

- CUA

- Customs Bank

- Defence Bank

- EML

- Endeavour Mutual Bank

- Firefighters Mutual

- First Option Bank

- Goulburn Murray Credit Union

- GO Mastercard

- Health Professionals Bank

- Heritage Bank

- Holiday Coast

- Horizon

- Illawarra

- IMB

- Intech

- Latitude Financial Services

- Macarthur

- MyState

- NBCU

- Nexus Mutual

- Orange Credit Union

- P&N Bank

- People's Choice

- Police Bank

- Police Credit Union

- Queenslanders

- RACQ Bank

- Reliance Bank

- SCU Banking

- SWSCU

- Teachers Mutual

- UBank

- UniBank

- Up Bank

- Unity Bank

- Virgin Money Australia

- WAW

- WECU

- 28 Degrees Platinum Mastercard

Fitbit Pay

What is it?

Launched with their first smartwatch, the Fitbit Ionic. Fitbit Pay allows for contactless payments.

Credit: Fitbit

Credit: Fitbit Who can use it?

At present, Fitbit Pay is available on the Fitbit Ionic, Fitbit Versa and Fitbit Band 3.

How many banks are supported?

At present, only about a dozen Australian banks support Fitbit Pay - and some of these institutions only support specific types of credit cards. Compared to Google, Apple and Samsung Pay, Fitbit Pay is quite limited.

Which major Australian banks support Fitbit Pay?

- ANZ

- Bendigo Bank

- Commonwealth Bank of Australia

- Macquarie Bank (Mastercard only)

- NAB and Westpac

Which smaller Australian banks support Fitbit Pay?

- Credit Union SA Limited (Visa)

- Heritage Bank

- Illawara Credit Union (Visa)

- Latitude Financial Services

- MyState Bank Limited (Visa only)

- UBank

- IMB Bank (Visa only)

Garmin Pay

What is it?

Off the back of their competition launching their own mobile payments platform, Garmin have readied their own mobile payments service for use with their current and future wearable products.

Credit: Garmin

Credit: Garmin Who can use it?

Garmin Pay can be found on most of Garmin's newer smart and sportswatches including the Farmin D2 series, the Fenix 5 series, the Forerunner 945, the Forerunner 645, the MARQ series plus the Vivoactive 3.

How many banks are supported?

At launch, only Commonwealth Bank customers in Australia were able to use Garmin Pay. However, several other banks have since come in board including ANZ, NAB and Westpac.

Which major Australian banks support Garmin Pay?

- ANZ (Visa only)

- Bendigo Bank (Mastercard only)

- Commonwealth Bank

- NAB (Visa only)

- Westpac

Which smaller Australian banks support Garmin Pay?

- Community Alliance Credit Union (Visa only)

- Credit Union SA (Visa only)

- Cuscal (Visa only)

- Heritage Bank (Visa only)

- IMB Bank (Visa only)

- Illawarra Credit Union

- Latitude Financial Services

- MyState Bank (Visa only)

- Up Money (Mastercard only)

Which mobile payments service should I be using?

The simplest answer here is that the best mobile payments service is the one that you can actually use. If you’re not already invested in the Apple ecosystem and your bank doesn’t support it, there’s not much point in trying to engage with Apple Pay. Mobile payments can be convenient but, for most users, they don't provide enough value on their own to justify buying a specific phone to get access to them.

However, if you’re in the position of already owning a Samsung or NFC-enabled Android device, it may be worth setting up the relevant mobile payment platform and seeing whether or not that extra little bit of convenience makes a difference.

Credit: Garmin

Credit: Garmin As with all these kinds of technical things, your mileage may vary but you won't know how useful and how valuable digital wallets and mobile payments systems like Google, Apple and Samsung Pay are going to be for you until you try them out for yourself.