Desktop CPU sales plunge 30% but AMD soars even higher

- 12 May, 2022 12:58

Shipments of desktop PC CPUs fell by more than 30 per cent during the first quarter of 2022, according to Mercury Research. That's the largest drop in desktop CPU sales in history.

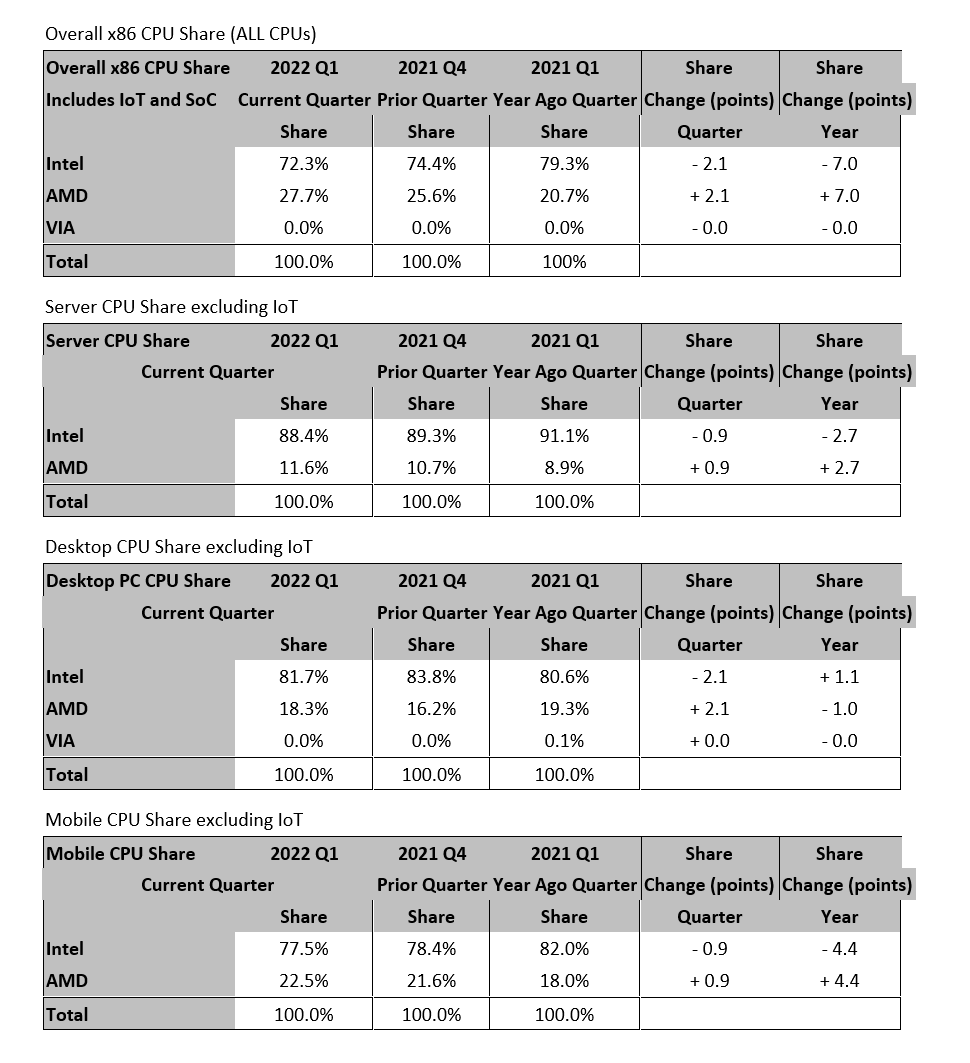

The drop hit Intel far harder than AMD. AMD's all-inclusive unit share, which includes PC CPUs, server CPUs, and the semi-custom processors used in gaming consoles, topped 27.7 per cent, a record high for the company that handily exceeds the record 25.6 per cent share that it recorded last quarter, Mercury added.

Average prices for the combined notebook and desktop market also set a record at US$138, the highest combined average price ever recorded, Mercury said.

Both Intel and AMD saw steep declines in desktop CPU shipments in the first quarter, but AMD's declined at a lower rate than Intel's, resulting in AMD gaining desktop share for the quarter, Mercury's principal analyst, Dean McCarron, wrote in a note to clients and reporters.

Since part of the decline in the first quarter was due to excess CPU inventory, it's likely that Intel was more impacted by the inventory than AMD. Intel's desktop growth remained higher than AMD's on an on-year basis, so Intel gained share compared to a year ago in desktop CPUs.

In mobile CPUs, both Intel and AMD saw declines, but AMD's declines were smaller and resulted in share gain for AMD, McCarron reported.

In an email, McCarron said that he believed that the desktop CPU drop was indeed the largest in history, though he said that he has tracked market-share data beginning in 1993.

There's a chance there was a bigger percentage drop in X86 processors in 1984 when the PC market imploded, though certainly not in unit terms as the drop in Q1 2022 units was multiples of the size of the entire market for the year way back then, McCarron wrote.

AMD recently reported record first-quarter revenues while adding an additional Dragon Range chip. Intel, for its part, presented a more cautious outlook governed by the uncertainty of COVID lockdowns.

Meanwhile, ARM CPU sales continued to climb, helped by Apple's M1 Macs. Mercury estimated the ARM PC client processor share at 11.3 per cent, up from 10.3 per cent last quarter and almost double the 5.9 per cent growth the segment recorded a year ago.