Coronavirus could see Disney+ fall further behind Netflix

- 27 March, 2020 14:25

disney-plus-logo-100817726-orig.jpg

Right from the get go, quantity has never been the play for Disney’s streaming service: Disney+.

Back in February 2018, then-CEO Bob Iger said Disney+ “will not necessarily go in the volume direction that Netflix has gone.”

“Using well-known IP — we’re making series based on Monsters, High School Musical, Star Wars — will give us the ability to probably spend less than if we’d come to market without these brands.”

While their library of things to watch on Disney+ is certain to grow in size over time, right now, Disney is looking to do more with less.

However, with more consumers self-isolating in the wake of COVID-19, that quality could become a serious hiccup for the company’s long-term plans to compete with Netflix.

A tale of two media companies

In order to understand the problem that the outbreak of COVID-19 represents to Disney’s obvious ambitions to topple Netflix as the king of the streaming industry, you first need to understand the difference between how the two are approaching the market.

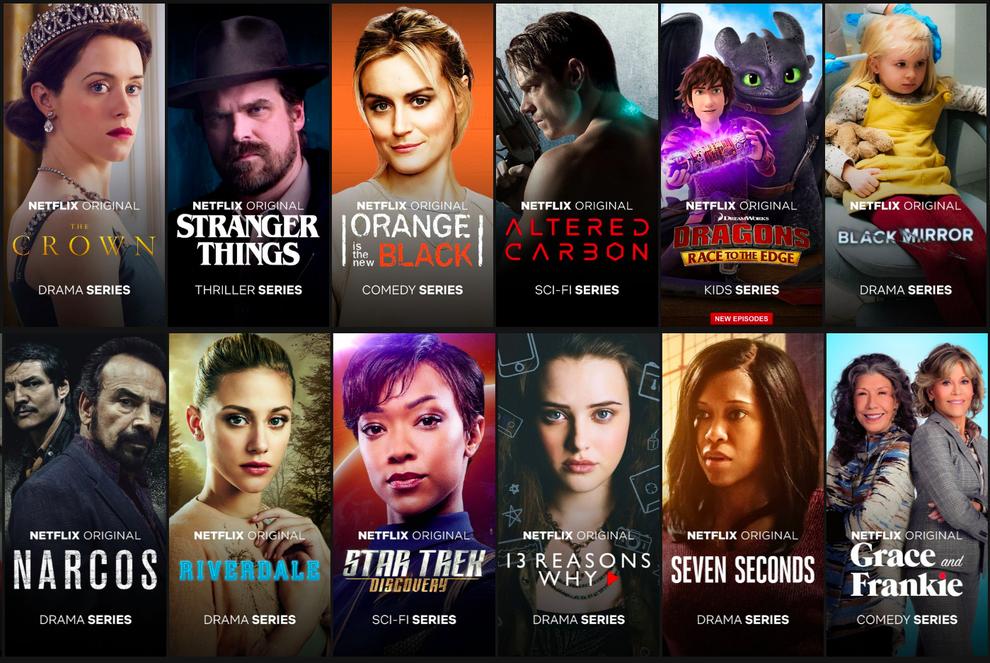

Until relatively recently, Netflix’s focus has been on the volume side of the equation. Quality has always been (and is increasingly) important but it’s often been secondary to quantity in a practical sense.

CEO Reed Hastings famously said that the company’s biggest competitor wasn’t Amazon but sleep. A big part of the company’s value proposition has been the fantasy of a platform where you never run out of things to watch. In pursuit of this goal, the streaming giant has pumped more and more money into content creation each and every year.

Credit: Freestocks

Credit: FreestocksWhen Netflix first launched, much of their catalogue was licensed. However, as the space has become more contested, much of that licensed content has been reclaimed by the original producers for use in their respective streaming ecosystems. This represents something of an existential problem for Netflix.

In 2019, Netflix spent US$15 billion buying, making and licensing content. And, as more and more competitors enter the streaming market, Netflix is looking to maintain its lead in the streaming market in the only way it knows how: investing in even more things for audiences to binge-watch.

Credit: Netflix

Credit: Netflix If there’s always something new to watch on Netflix, it’s always going to be the last streaming service on the chopping block.

As mentioned in the intro, Disney’s approach to capturing the monthly subscription dollars of consumers is slightly different.

In the short term, their value proposition is more akin to a traditional tentpole movie release. They want to be the streaming service that sets the mainstream cultural conversation with big mainstream hits like The Mandalorian.

Then, over the long term, they’re looking to leverage the emotional investment and fandom attached to properties like Star Wars, Marvel and Frozen, by being the only place you can watch those franchises.

By pairing these qualities with a competitive price-point, Disney makes it easy to justify their streaming service as a complement to mainstays like Netflix.

In 2019, Disney essentially spent $1 billion on content that brought in approximately 28 million subscribers as of February. In contrast, Netflix spent roughly fifteen times that amount to hold onto their own base of 167 million global subscribers.

Admittedly, this isn’t an entirely fair comparison since Disney launched quite late in the year but it does reflect the differing approaches of the two platforms.

What’s the problem then?

At the time of writing, two of Disney’s biggest original TV series - WandaVision and Falcon and The Winter Soldier - have paused production due to coronavrius concerns and, with the worst of the pandemic ahead of us, it’s unlikely that they will find themselves back on schedule in time to meet their previous release dates.

At best, one or both shows may end up being pushed into 2021. While there are plenty of old classics and blockbuster films that Disney can deploy in the meantime, the absence of any tentpole streaming shows spells trouble for Disney’s ambitions to grow enough to eventually match Netflix in size and scale.

Credit: Fergus Halliday

Credit: Fergus Halliday Disney’s strategy of going in on quality over quantity yielded early success but, as coronavirus slows the pipeline of new content to a trickle, that approach feels like it has real potential to backfire on the company.

Simply put, the medium and long-term effects of coronavirus on Disney's wider production process means that Disney+ is likely to run out of new original content a lot sooner than Netflix will.

For every customer who stays subscribed to Disney+ for easy access to family-friendly classics like Frozen or Star Wars, there’s a customer who is going to bail once it becomes clear that the service likely won’t have new original for quite some time.

In contrast, Netflix’s perhaps-excessive commitment to generating content might actually put them in the best position to persevere through the inevitable impacts of the pandemic.

Even if they stopped commissioning new content today, the sheer amount of shows and films already in Netflix's production pipeline means that they can afford to slow down and adapt to changing market conditions and still keep giving viewers new stuff to watch.

Nobody really knows what’s going to happen. Who knows, maybe the inability to efficiently produce life-action content might end up pushing Netflix and Disney to invest in more animated content.

Maybe they’ll even bring back Tuca and Bertie.

Credit: Disney

Credit: Disney